Uhh your definition of income is...wrong.

You just used profit and income interchangeably. They are not.

Income = Revenue Not profit.

revenue can also mean gross, total. my apologies for being loose. income is what is left over. if you extend your labor for X and receive in return Y worth X, there is no profit. if there is no profit, there is no income.

“There is a clear distinction between ‘profit’ and ‘wages’ and compensation for labor cannot be regarded as profit within the meaning of the law. The word ‘profit’, as ordinarily used, means the gain made upon any business or investment - a different thing altogether from mere compensation for labor.” Oliver v. Hastead, 86 S.E. Rep. 2d 859

“Income within the meaning of the Sixteenth Amendment and the Revenue Act, means ‘gain’… and in such connection ‘Gain’ means profit… proceeding from property, severed from capital, however invested or employed, and coming in, received, or drawn by the taxpayer, for his separate use, benefit and disposal… Income is not a wage or compensation for any type of labor.” Stapler v US, 21 F Supp 737 AT 739

“…Congress has taxed income, not compensation” Connor v US, 303 F. Supp., 1187 ’69

“Income, contrary to popular belief, is not a wage, salary, fee, first-time commission, or compensation for any kind of labor, unless consented to by contract.” US vs Ballard 536 F. 2d 400, 404 (8th CIr. 1976)

“The labor of a human being is not a commodity or article of commerce…” Title 15 USC 17

I got a hundred more…

I pay all the taxes I am supposed to. I do not protest. I do not fight. I am 100% against the SC movement and disagree with the active validity of state citizenship. I sojourn, seek truth, live in best way I can, and seek to obey my Creator daily (even tho i fail). Thats it.

I thought you had stated here you were a Juris Doctor in the past. AM I mistaken?

Because clearly publicly giving unsolicited and inaccurate advice on the basis of established legal precedent is highly frowned upon.

i have given zero advice. i have merely stated a fact and in no way have i stated an option that is a fact *should* be exercised by others, but merely that it is an option at law. i got out after seeing the anal seep, wrote a book, and then lived my life.

Some argue that the IRS is not an agency of the United States but rather a private corporation, because it was not created by positive law (i.e., an act of Congress) and that, therefore, the IRS does not have the authority to enforce the Internal Revenue Code.

The Law: Constitutional and statutory authority establishes that the IRS is an agency of the United States. Indeed, the Supreme Court has stated, “[T]he Internal Revenue Service is organized to carry out the broad responsibilities of the Secretary of the Treasury under § 7801(a) of the 1954 Code for the administration and enforcement of the internal revenue laws.” Donaldson v. United States, 400 U.S. 517, 534 (1971).

Wikipedia? The bold part is opinion. The actual law you quoted does not inherently directly or indirectly say the IRS is a government agency, merely authority.

I have attached a document for your attention. From the US attorneys office that I have acquired. This is the US Attorney’s office saying this and I have scanned it for you so you can see the stamp. Pay attention to page 2 item number 4. “Denies that the Internal Revenue Service is an agency of the United States Government but admits that the United States of America would be a proper party to this action…”

The IRS warned taxpayers of the consequences of attempting to pursue a claim on these grounds in Notice 2010-33, 2010-17 I.R.B. 609.

No one! has attempted to pursue a claim or has advocated pursuing a claim. God and his infinite wisdom told us what to do when we find ourselves enslaved: Slaves, obey your masters, for honor to your master shows honor to your Creator (Ephesians, Colossians, 1 Peter…)[must be taken in context. you don't disobey your Creator if your master ask you to do something you're not supposed to…]

It has been merely vaguely lightly barely suggested that when AT LAW a better option is available, it would be perhaps wise and advantageous to take advantage where one is legally allowed to do so.

United States v. Fern, 696 F.2d 1269, 1273 (11th Cir. 1983) – the 11th Circuit declared, “Clearly, the Internal Revenue Service is a ‘department or agency’ of the United States.”

Yes because this clearly informs where in the court proceedings this is quoted form, the surrounding text and provides a definitive statement of positive fact that is not blatantly apparent with a negative pregnant.

United States v. Provost, 109 A.F.T.R.2d (RIA) 2012-1706 (E.D. Cal. 2012) – the court rejected the taxpayer’s arguments and stated that the United States is “a sovereign, not a corporation,” the IRS is a government agency, and that arguments to the contrary are “wholly frivolous.”

hahahah. so the US is a sovereign and the IRS is a sovereign??? this is a new one. Again where in the case? Who is speaking? Where clarifications indicated after that? Lets say correct… thats even worse. Do you know the definition of a sovereign?

Salman v. Dept. of Treasury, 899 F.Supp. 471, 472 (D. Nev. 1995) – the court described Salman’s contention that the IRS is not a government agency of the United States as “wholly frivolous” and dismissed his claim with prejudice.

Nevius v. Tomlinson, 113 A.F.T.R.2d (RIA) 2014-1872 (W.D. Miss. 2014) – the court granted summary judgment in favor of the government, rejecting Nevius’s claim that the IRS is a private corporation, rather than a government agency.

state level. not a quote. summary statement by whom? I can argue the sky is blue and still have my case thrown out because I argued poorly. Doesn't mean the sky isn't blue. “Mr. Doe claimed the sky was blue, and the court did not recognize Mr. Doe’s claims”. Does NOT mean the claims were invalid…

Edwards v. Commissioner, T.C. Memo. 2002-169, 84 T.C.M. (CCH) 24 (2002) – the court dismissed the argument that the IRS is not an agency of the United States Department of Treasury as “tax protester gibberish” and stated that “t's bad enough when ignorant and gullible or disingenuous taxpayers utter tax protester gibberish. It's much more disturbing when a member of the bar offers tax protester gibberish as a substitute for legal argument.”

same thing.

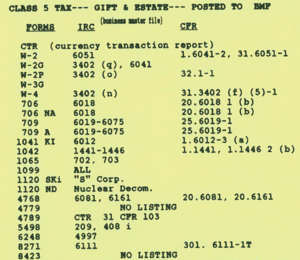

I have also attached for you a piece of an actual IRS document from their internal manuals showing the actual tax classification and the associated forms of tax class 5. later i went on to actually be able to acquire their entire manual via foia, however they did end up deleting a few chapters and not allowing me to see. Either way... begs answers to many many questions...

I have also attached a document received by a client. If you know anything about positive law vs special law, it is quite revealing. Helps to better understand how “income tax” is a really a “excise tax” ( a toll ), when so much evidence amounts that a "gains" tax on labor is not legal… but where a special law "excise tax" is very legal

I have folder after folder after folder. Document upon document. I have even managed to get ahold of a copy of the original incorporation document for the IRS.

Gotta get back to work now[/QUOTE]