I've been with USAA for ten years, and finally got around to comparing rates. Sheesh. We've been getting ripped off. I get the feeling that by staying with a company, your rates become less and less competitive as you get passed by and get burdened with the constant annual increases.

Progressive was $744 less a year on Auto, but almost TWICE on home insurance. Which was kind of weird, so I kept USAA for home, and changed to Progressive for auto.

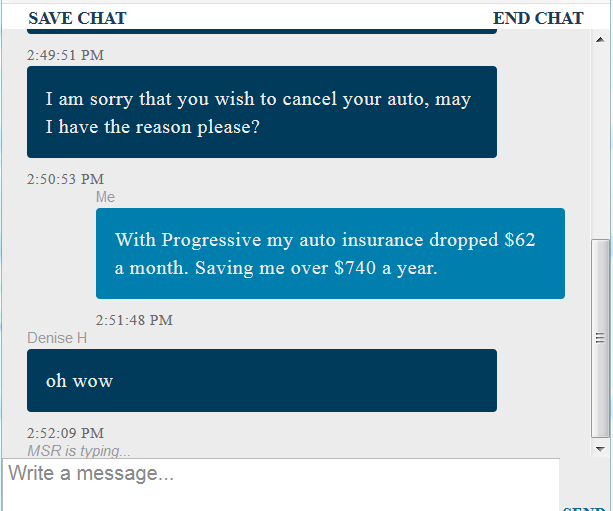

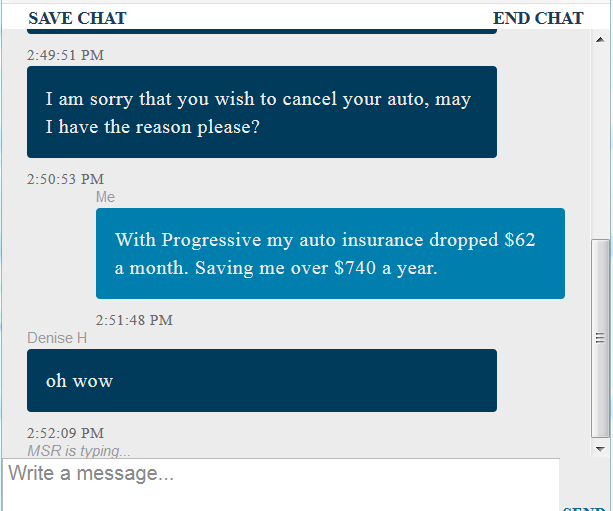

This was an entertaining conversation from when I cancelled the auto insurance today.

Progressive was $744 less a year on Auto, but almost TWICE on home insurance. Which was kind of weird, so I kept USAA for home, and changed to Progressive for auto.

This was an entertaining conversation from when I cancelled the auto insurance today.