drkelly

Dipstick who put two vehicles on jack stands

- Joined

- Mar 21, 2005

- Location

- Oak Ridge/Stokesdale, NC

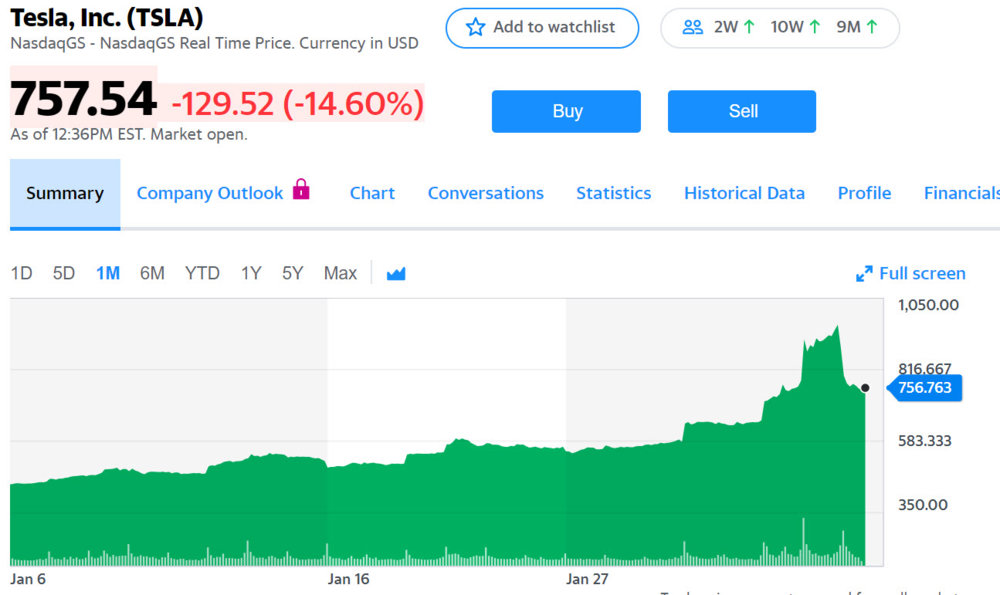

Somebody did a pump and dump on Tesla.

wow

So, I Should have called it, "Lost Revenue", & concentrated on Global Market, instead of Airlines! How silly of me!We are going into the weeds...lost revenue does not equal loss.

if I am a business and I sell widgets for $10 that cost me $8 to make. And I make them on demand.

If I make a batch of bad widgets and pay for them that is a loss. If less people buy widgets this month than I projected that is a revenue shortfall, not a loss. While it isnt good and it doesnt feed the monster, they also dont have the expense of running those flights.

From this article:

“China represents about 3.8 percent of all the international seats for American, Delta, and United,”

How the coronavirus outbreak is affecting travel

Some insiders definitely got rich on that move.

This is dumb. My guess is Trump is scared the market will crash before the election, which will hurt his chances at re-election. I think he wins the election anyway.

White House considering tax incentive for more Americans to buy stocks, sources say

We are going into the weeds...lost revenue does not equal loss.

if I am a business and I sell widgets for $10 that cost me $8 to make. And I make them on demand.

If I make a batch of bad widgets and pay for them that is a loss. If less people buy widgets this month than I projected that is a revenue shortfall, not a loss. While it isnt good and it doesnt feed the monster, they also dont have the expense of running those flights.

Add that to the Global Supply chain of parts, food & resources, taking a Hit. O well, wait & see. Hopefully, Nothing!Some new #'s today on the bottom line impact of the virus to the aviation industry: 10 fast facts: How COVID-19 impacts global airline operations - Cirium - A Smarter Way to Travel

Been there for 2 months now, waiting on the storm to start, haha!I backed my 401K to conservative. Hopefully it'll weather the storm

I backed my 401K to conservative. Hopefully it'll weather the storm

What’s your target retirement date? Call me dumb but isn’t the best advice to just leave your 401k alone. It should be pretty diversified to handle a dip. I was told not to try and beat the market. Flame suit on

Sent from my iPhone using Tapatalk

2043. God that hurts typing. It probably is the best advise but I want to see the number go up. Never down. I'm too cautious for the stock market

Now, when the stock are going up (eventually) you’ll miss it.

Sent from my iPhone using Tapatalk