benXJ

Well-Known Member

- Joined

- Dec 5, 2005

- Location

- Raleigh NC

Don’t forget, you can appeal your property value.

What happens if I don't pay? You know, pay a 'tax' on something I bought and paid for 30 years ago? Oh, with after tax money.

Don’t forget, you can appeal your property value.

But if they look again, they might decide to up it even more! I'm in that spot that probably most of yall are, where the tax value is way too high in my opinion, but the market value is also way higher than tax value.Don’t forget, you can appeal your property value.

I did that on one of my older cars. they took 2/3 off the value.Reminds me I need to appeal the value of my 67 c50. If they say it's worth $21,000 then they should have to buy it from me for that. Lol.

40%+ of that sq footage must be the basement, which is 90% sub terrain. The footprint of that house isn't that big. And if you look closely a big chunk of it isn't finished (the 2nd lower garage?).

At least there's a lot of room for cars.

Don't pay and let us know what happens.AND now we know what the problem is....apathy. Can't control? What non-sense is that?

Who said you HAVE to pay them? Why are 'they' still in power?

I'm not angry, I do my part to vote the corrupt morons out of office....just spreading the word in hopes enough catch on and things change. Things can change. We do control it.

As right as you are, if it is that easy, then have you considered that maybe you are in the minority, and the majority likes it how it is?AND now we know what the problem is....apathy. Can't control? What non-sense is that?

Who said you HAVE to pay them? Why are 'they' still in power?

I'm not angry, I do my part to vote the corrupt morons out of office....just spreading the word in hopes enough catch on and things change. Things can change. We do control it.

And yet to date you have not proposed any actual viable solution that is any better or possible.nobody? no 'group'? was the ability to tax me every year on some non-realized, arbitrary 'value' on my house carried down the mountain by Moses? and if I don't pay or don't agree, they can take my paid for house. madness.

'needing' money to operate is not the same as 'no one can change or enact tax laws and procedures'

never ONCE have I said we should pay no taxes or that taxes aren't needed.

No, the problem is lack of a person leading the charge with a better solution. That is actually possible, not just rants and pipe dreams.AND now we know what the problem is....apathy. Can't control? What non-sense is that?

Or, similarly, the majority have learned they don't have a better solution either and aren't wasting their time changing something they can't make better.As right as you are, if it is that easy, then have you considered that maybe you are in the minority, and the majority likes it how it is?

which is irrelevant unless he actually has a means or plan to use said power based on a novel, actionable, viable plan..benxj said:who told the guy in the tax office what to do?

Sounds like the mayor/council;/commissioners (all elected officials) have the power

I know they say beauty is in the eye of the beholder, but that is FUGLY!And to give a little perspective...I either have weird shit like this, if I want acreage:

160 Johnson Dairy Rd, Rockwell, NC 28138 | Zillow

160 Johnson Dairy Rd, Rockwell NC, is a Single Family home that contains 3729 sq ft and was built in 1987.It contains 2 bathrooms. The Zestimate for this Single Family is $619,700, which has decreased by $2,547 in the last 30 days.The Rent Zestimate for this Single Family is $3,191/mo, which...www.zillow.com

Depends what you mean by "history".

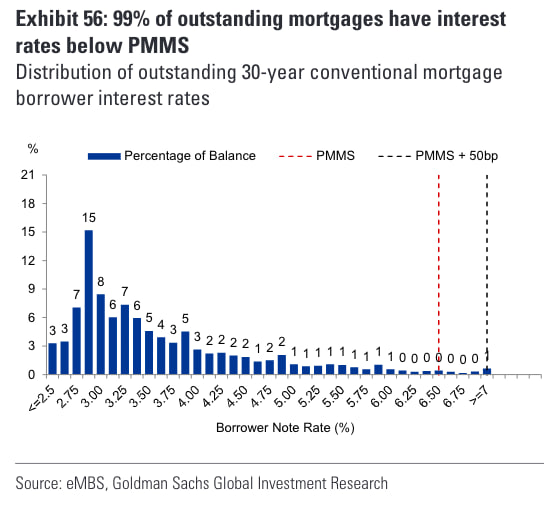

Its been about 15 years since this high.

So the only people with mortgages today who may have an interest rate higher would be somebody who has been in their current place for that long AND did not refinance during any of the much lower past, which would be insane not to.

What % of the population is that? It has to be a tiny amount of the mortgage market share.

FYIThe answer should be basically none, but I bet it's more like 30-40%. I had a coworker who's mortgage was north of 5%, but didn't want to refi when it was below 3% because they had "been in the house too long and it wasn't worth it". They also were cash strapped, and I pointed out they could get a higher rate and credit back or cash out and STILL pay less in interest, and they just looked at me like a deer in headlights.

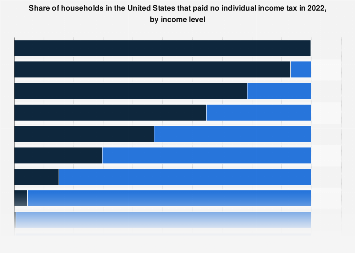

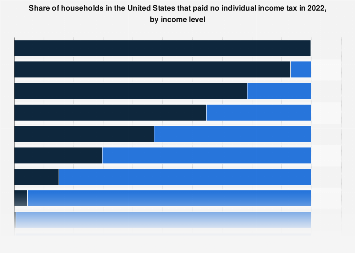

52% of Americans pay $0 in Federal tax. Many of those get additional rebates.the majority likes it how it is?

explain? why how where.......clueless on this52% of Americans pay $0 in Federal tax. Many of those get additional rebates.

Well, to start with, most kids don't pay taxes, so that's 1/4 of the population. Which leaves 1/3 of the remaining population, which sounds about right.explain? why how where.......clueless on this

damn I wanted a more confusing answer......duh!Well, to start with, most kids don't pay taxes, so that's 1/4 of the population. Which leaves 1/3 of the remaining population, which sounds about right.

Because of deductions and the distribution of income, a lot of people fall below the line of actually owing any Federal taxes.explain? why how where.......clueless on this

Because of deductions and the distribution of income, a lot of people fall below the line of actually owing any Federal taxes.

It isn't actually over 50% any more though, but last year it was

This article explains a little more

Share of households paying no income tax by income level U.S. 2025| Statista

In total, about 60.4 percent of U.S.www.statista.com

57% of U.S. households paid no federal income tax last year as Covid took a toll, study says

More than half of Americans paid no federal income tax last year due to Covid-relief funds, tax credits and stimulus, according to a new report.www.cnbc.com

EDIT: although a couple years old now, some interesting statistics here

Summary of the Latest Federal Income Tax Data, 2025 Update

New IRS data shows the US federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates. Average tax rates for all income groups remain lower after the Tax Cuts and Jobs Act (TCJA).taxfoundation.org

Do you habitually cite sources that release year end assessments in October?

Google better next time.

You sir get a demerit for no link!

He should Google better next time..gov fiscal year ends in October. Cut him some slack

It's as simple as a trip to the tax assessor office and filing a dispute.Welp Meck co just published new tax values. Mine just went up by 50%. And its 20k over Zillow. Need to find the resources to fight that.