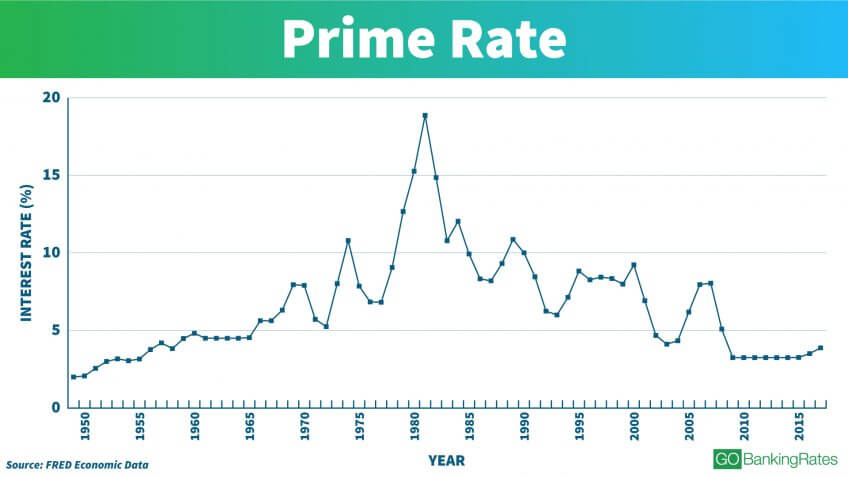

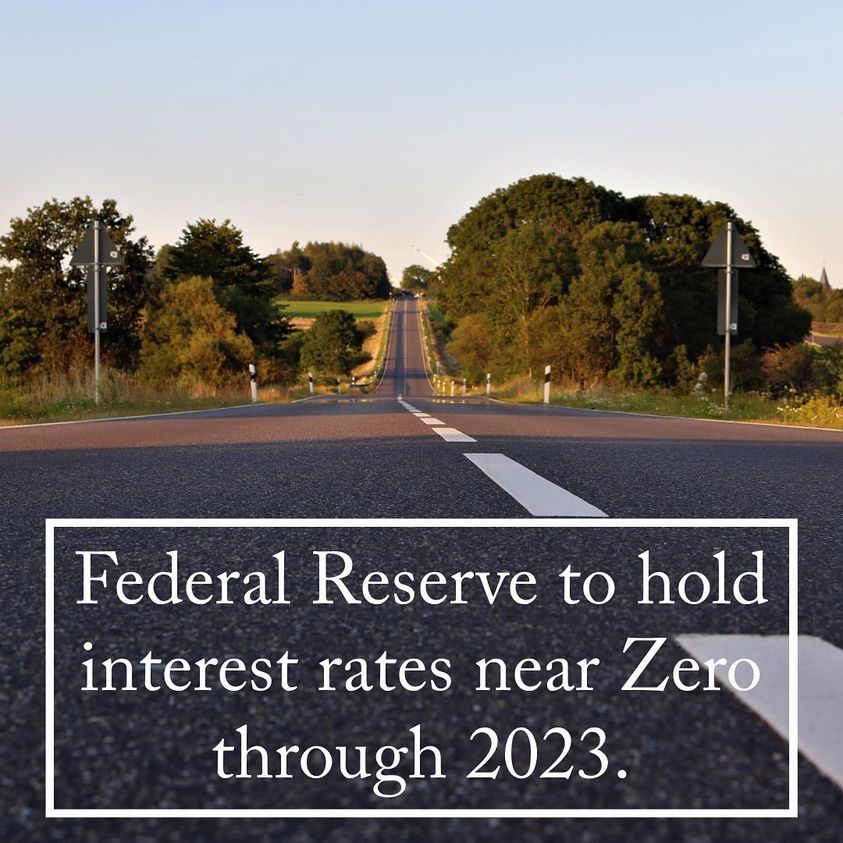

Given current equity value it's tempting to accept this outright, but there's a variable missing from the 'Buffett Indicator'. Considering only GDP and stock value leaves out any correction for the income potential from other investment sources. People are willing to pay more for stocks because rock bottom interest rates have driven returns of every other paper investment class into the ground.

The height of the 'overvalued' peak is also exacerbated by the drop in GDP due to Covid shutdowns. Optimists would tell you that once the vaccine hits it will be game on for 3% growth per quarter, and stocks trade at future earning potential, not current earnings. The question becomes, do you believe the optimists?