drkelly

Dipstick who put two vehicles on jack stands

- Joined

- Mar 21, 2005

- Location

- Oak Ridge/Stokesdale, NC

Woke = retard

woke = retarded wordWoke = retard

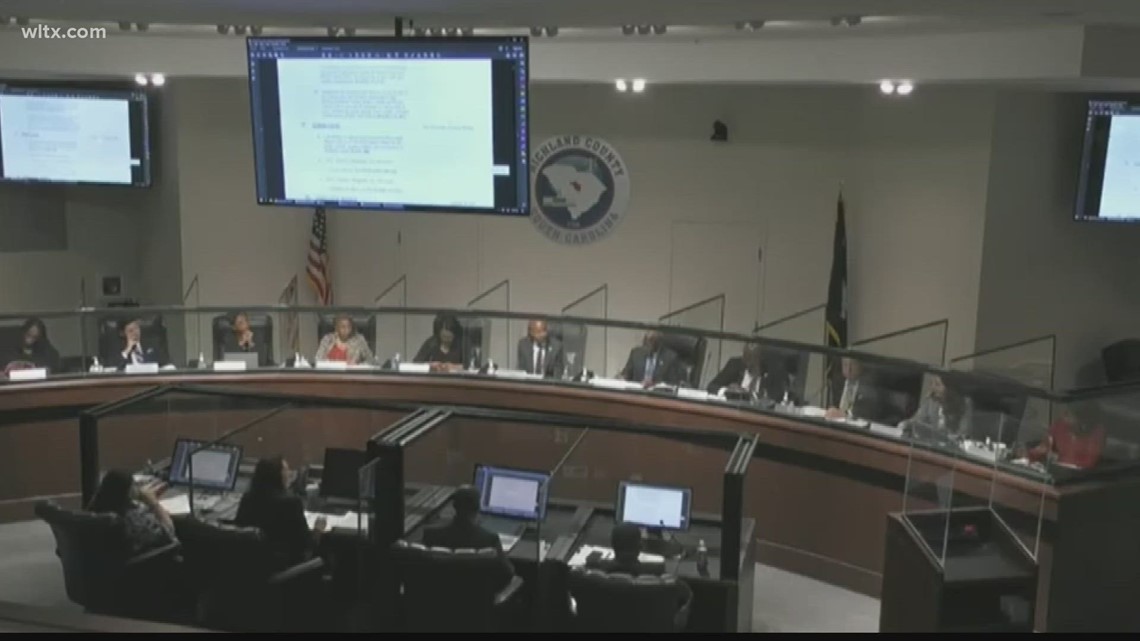

Haven't seen anything that recession starting since 2008. How this ripples through the tech industry and markets could very well be the tipping point.

Here's how the second-biggest bank collapse in U.S. history happened in just 48 hours

As dust begins to settle on the biggest American bank failure since 2008, members of the VC community lament the role other investors played in SVB's demise.www.cnbc.com

Vc’s start a panic and make their clients run on the bank and makes the bank collapse

So the bank really didn't collapse.

Here's how the second-biggest bank collapse in U.S. history happened in just 48 hours

As dust begins to settle on the biggest American bank failure since 2008, members of the VC community lament the role other investors played in SVB's demise.www.cnbc.com

Vc’s start a panic and make their clients run on the bank and makes the bank collapse

The bank did collapse.So the bank really didn't collapse.

The Feds are making sure everyone is whole, by taking control and using your tax dollars and FDIC money (that would be used for other bank runs) and giving it to speculators and investors. Re-distribution if you will.

So is the FDIC insurance more than $250,000 now?

Are there no negative repercussions for dumb/stupid/ignorant/corrupt banking behavior anymore?

It seems that money really has no 'value' as most already believe. Wonder how much extra they'll print this time?

I guess you don't consider losing your job to be be harmed?

Silicon Valley Bank employees offered 1.5 times their pay by Feds | WRAL TechWire

By Ramishah Maruf, CNN The US Federal Deposit Insurance Corporation offered Silicon Valley Bank employees 45 days of employment and 1.5 times their salary, reports say. An FDIC official did not comment on the details to CNN, but said it is standard practice and one of the first steps the...wraltechwire.com

No employees are harmed either. You gonna get 1.5 times your salary as a bailout at your job if the boss messes up and over leverages?

You should really spend some time reading news articles that explain it... that were posted in other threads. See Online Credit Card CompaniesWhat?

Biden and Yellen ( the government) are sure acting like they are in charge here.

With directives and what not.

FDIC is for $250k. Who said to go above?

I miss the storefront. Back when I worked over in NE Columbia and there was the FN store and PSA was just the little front room of the warehouse lunch breaks were dangerous and costly.Looks like FN want's to expand in Columbia.

Richland County discusses proposed $16.5 million factory expansion

The project would bring 100 new jobs to a local gun manufacturer.www.wltx.com

The most fascinating thing about this article is that alligators are now a unit of measurement.

Massive Asteroid About the Size of 69 American Alligators Will Pass by Earth Tuesday, NASA Warns

A huge asteroid will pass by Earth Tuesday. Read the article for the details. (Photo : Wikimedia Commons/Sebastian Kaulitzki/Science Photo Library/Corbis) Massive Asteroid About the Size of 69 American Alligators Will Pass by Earth Tuesday, NASA Warns Another huge space rock is heading our waywww.sciencetimes.com

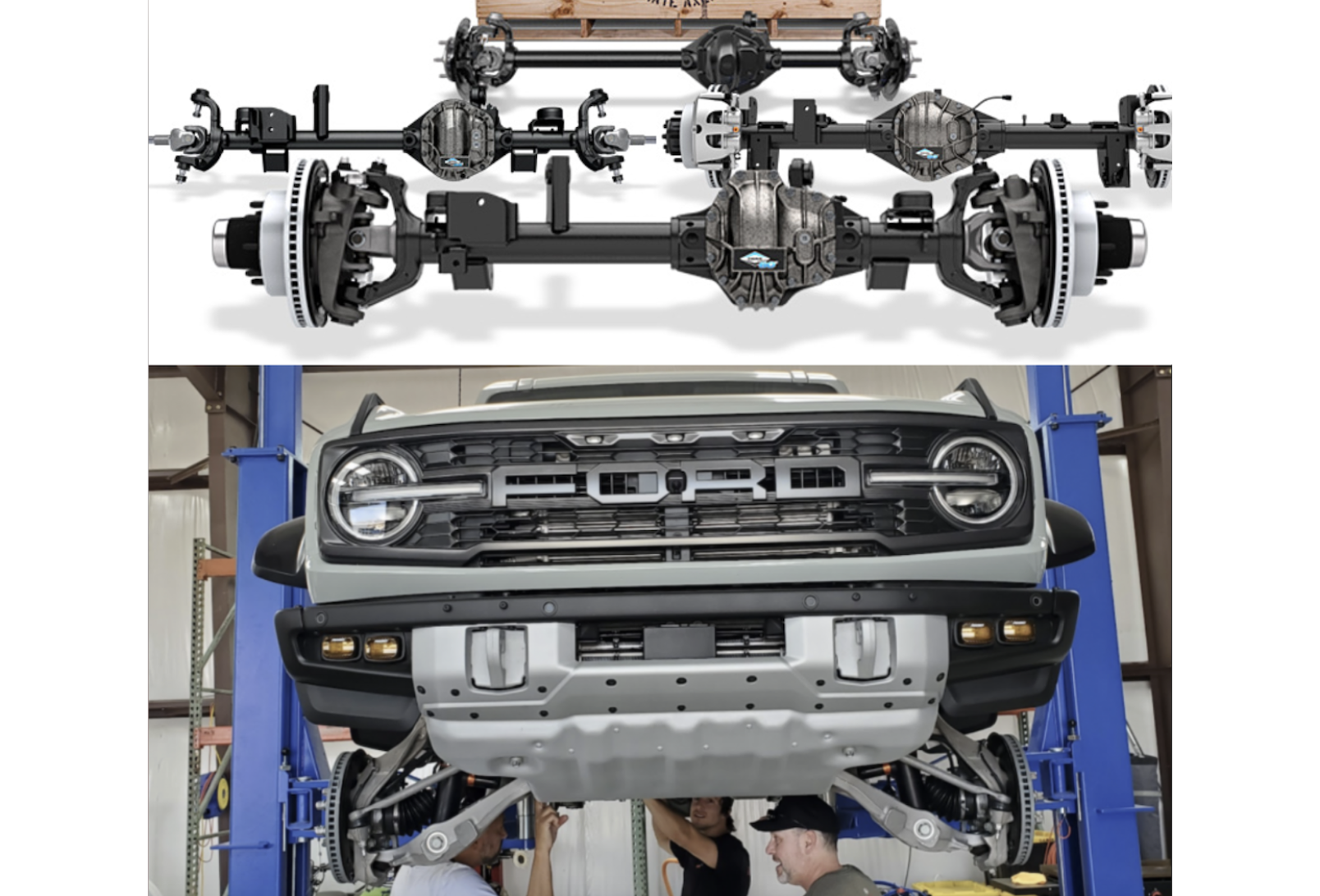

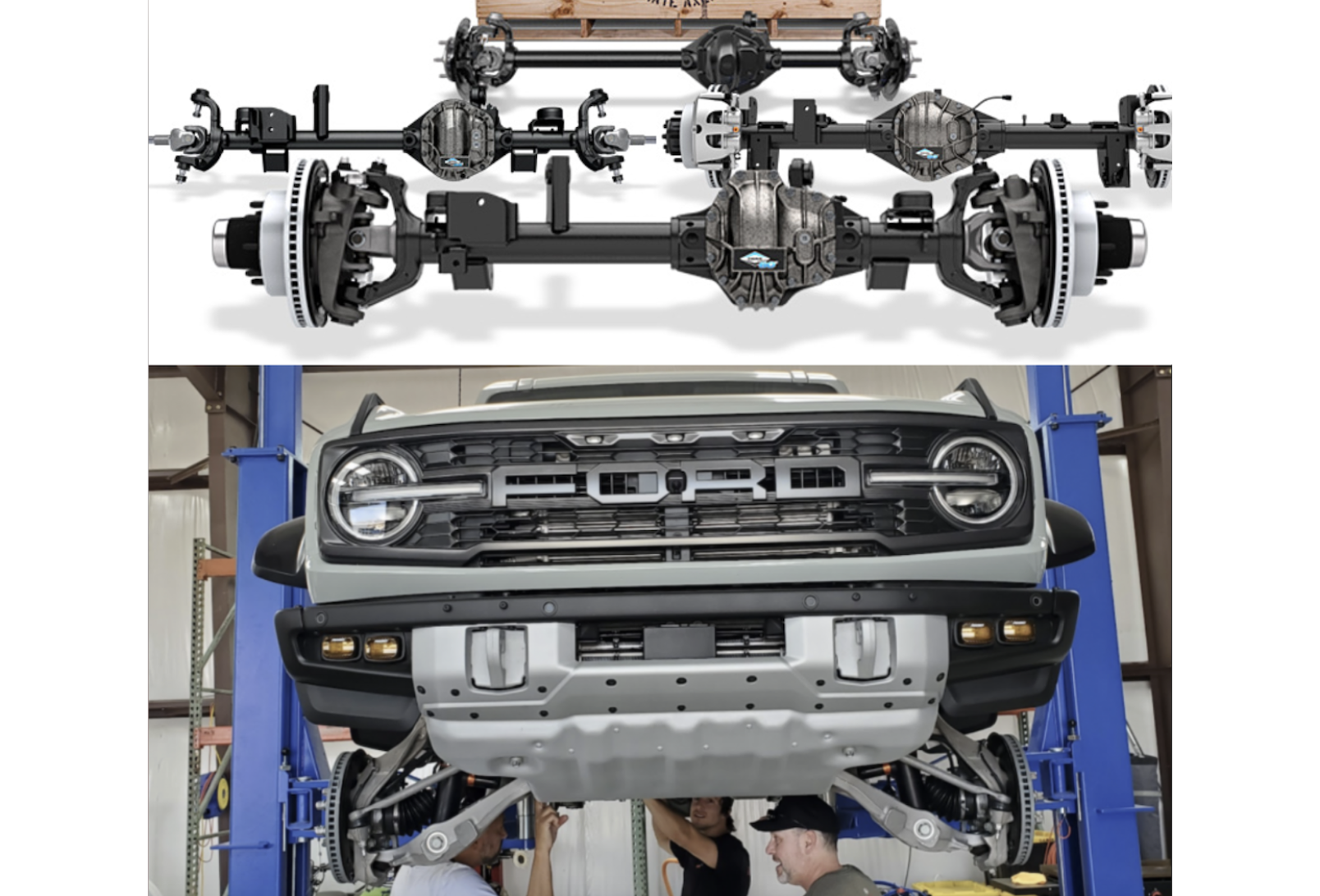

For such an in-depth assessment, it completely overlooked the greatest advantage of solid axles offroad:I don’t know where this belongs, so I’m putting it here

Our Suspension Engineer's Take On The 'Solid Axle vs Independent Suspension' Off-Road Debate - The Autopian

As we quickly approach the one year anniversary of this illustrious website, I am reminded of how I came to be involved with this group of interesting, diverse, unusual, but eminently talented group of writers and car enthusiasts. It all started a few years ago when David Tracy was still working...www.theautopian.com

For such an in-depth assessment, it completely overlooked the greatest advantage of solid axles offroad:

Upward articulation on one side forces downward articulation on the opposite wheel. So when one wheel climbs up a rock, the other side tries to balance the load like a see-saw. An independent suspension is, well, independent, and can do no such thing. Upward force on one side simply reduces the contact force and therefore traction on the opposite side.